From April 2018 the UK will have three versions of land transaction tax and three types of landfill tax (in Scotland, Wales and the rest of UK). There are also likely to be six income tax bands for Scottish taxpayers. These changes are the result of the devolution of tax powers to Scotland and Wales, but they will impact wider communities. Be thankful that the tax reforms for Northern Ireland have stalled for now.

The dream of tax digitalisation has been punctured by hard reality, so the Making Tax Digital (MTD) programme has been restricted to VAT – registered businesses for the first stage and delayed by a year to April 2019. The Government fully intends to expand MTD to all businesses and landlords, but not until at least 2020.

In the meantime, certain taxes have effectively increased their scope by the freezing of allowances and thresholds. The nil rate band for Inheritance Tax (IHT) has been frozen until 2021, although this exempt amount can be increased when the deceased leaves the value of his or her home to a direct descendant. The VAT registration threshold has been set at £85,000 until April 2020 and this will draw more businesses into the VAT net by the operation of inflation.

Individual landlords of residential properties are already suffering a 25% restriction in the amount of interest they can set against their rental income, and this will increase to 100% from 6 April 2020. Landlords who have not already done so should review the structure of their property businesses and financing of those businesses with some urgency.

The tax reliefs available for specific categories of expenditure have to be claimed within a tight window, such as for the costs of research and development, for investing in the shares of certain small companies.

If you are likely to be affected, you may need to review the form in which you receive income, and the structures which you use to hold assets.

We recommend you undertake an annual review of your financial affairs to check if you are paying more tax than you need to and whether the structures you set up in the past are still appropriate.

Under self-assessment, your personal return for 2017/18 must be submitted and the tax liability settled by 31 January 2019; between then and the end of the tax year (5 April 2019) is a good time to assess whether you are as well defended against high tax charges as you can be.

Of course, the personal circumstances of each individual must be taken into account in deciding whether any particular plan is suitable or advantageous – but these suggestions may give you some ideas. We are happy to discuss them with you in more detail.

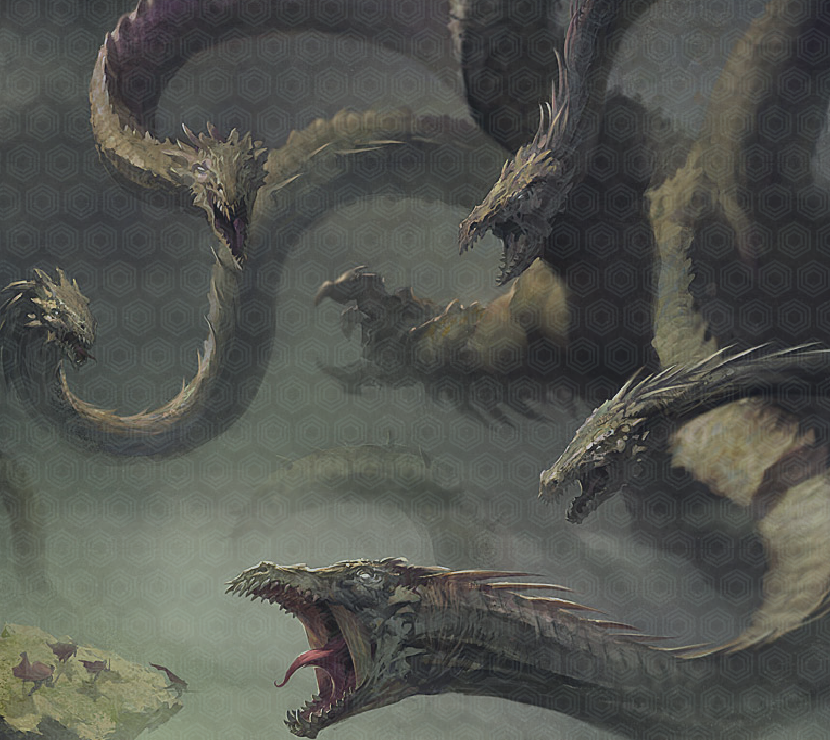

Click here to read the full article on Managing the Monster >>